The power of investing to build wealth and achieve long-term goals has been proven time and again. But not everyone takes full advantage. What separates the most successful investors from the rest?

Here are the 6 habits of successful investors that we’ve witnessed over the years—and how to make them work for you.

Develop a long-term plan—and stick with it

Tall tales about the lucky investor who hit it big with a stock idea may be entertaining. But for most people, investing isn’t about getting rich quick, or even making as much money as possible. It’s about reaching their goals—be they owning a home, sending a kid to college, or having the retirement they have long imagined.

Successful investors know that this means developing a plan—and sticking with it. Why does planning matter? Because it works.

A Fidelity analysis of 401(k) participants found that engaging in planning, either with a Fidelity representative or using Fidelity’s online tools, helped some people identify opportunities to improve their plans, and take action.1

Roughly 40{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of the people who took the time to look at their plan decided to make changes to their saving or investing strategy. The most common change was to increase savings, with an average increase of roughly 2.6{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of pay.2 The next most common action was a change in investments (see illustration below).

| Data based on guidance interactions during the 12 months through June, 2018. The study looked at participants in workplace savings plans and included both online tools and live discussions. |

A plan doesn’t have to be fancy or expensive. You can do it alone, or with the help of a financial professional or an online tool like those in Fidelity’s Planning & Guidance Center. Either way, by slowing down, focusing on your goals, and making a plan, you are taking the first and most important step.

Be a supersaver

While lots of attention is paid to how much your investments earn, the most important factors that determine your financial future may be how much and how often you save.

Fidelity’s Retirement Savings Assessment analyzed financial information for more than 4,500 families and found that on average, the single most powerful change that millennials and Gen Xers could make to improve their retirement outlooks was saving more. For workers closer to retirement, a combination of delaying retirement and saving more would have made the biggest difference, on average.2

How much should you save for retirement? As a general rule of thumb, Fidelity suggests putting at least 15{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of your income each year, which includes any employer match, into a tax-advantaged retirement account, though your individual situation may be different.

“You can’t control the markets, but you can control how much you save,” says Fidelity vice president and CFP® Ann Dowd. “Saving enough, and saving consistently, are important habits to achieve long-term financial goals.”

Stick with your plan, despite volatility

When the value of your investments falls significantly, it’s only human to want to run for shelter due to our inherent aversion to suffering losses. And it can certainly feel better to stop putting additional money to work in the market. But the best investors understand their time horizon, financial capacity for losses, and emotional tolerance for market ups and downs, and they maintain an allocation of stocks they can live with in good markets and bad.

Remember the financial crisis of late 2008 and early 2009, when stocks dropped nearly 50{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}? Selling at the top and buying at the bottom would have been ideal, but unfortunately that kind of market timing is nearly impossible. In fact, a Fidelity study of 3.9 million workplace savers found that those who stayed invested in the stock market during the downturn far outpaced those who went to the sidelines.3

From the fourth quarter of 2008 through the end of 2015, investors who stayed in the markets saw their account balances—which reflected the impact of their investment choices and contributions—grow 147{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}. That’s twice the average 74{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} return for those who moved out of stocks and into cash during the fourth quarter of 2008 or first quarter of 2009.3 More than 25{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of the investors who sold out of stocks during that downturn never got back into the market—missing out on all of the recovery and gains of the following years. The vast majority of 401(k) participants did not make any asset allocation changes during the market downturn, but for those who did it was a fateful decision that had a lasting impact.

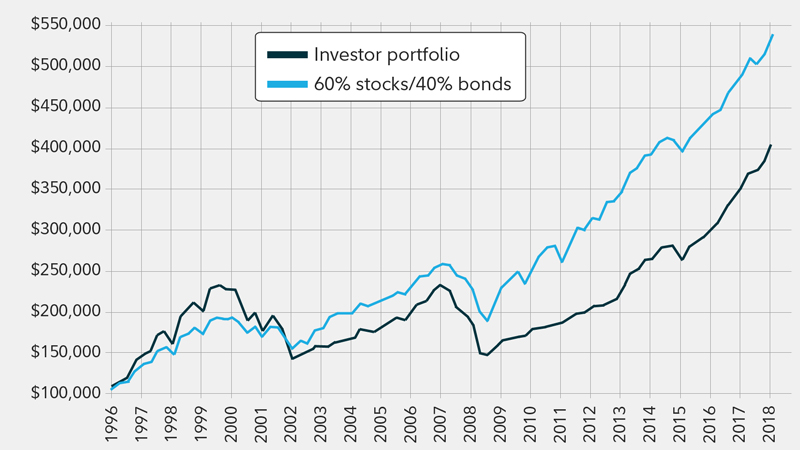

If you are tempted to move to cash when the stock market plunges, consider a more balanced, less volatile asset mix that you can stick with. Imagine 2 hypothetical investors—an investor who panicked, slashed his equity allocation from 90{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} to 20{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} during the bear markets in 2002 and 2008, and subsequently waited until the market recovered before moving his stock allocation back to a target level of 90{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}; and an investor who stayed the course during the bear markets with a 60{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}/40{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} allocation of stocks and bonds.4

As you can see below, the disciplined investor significantly outperformed the more aggressive investor who pulled back his equity exposure radically as the market fell. Assuming a $100,000 starting portfolio 20 years ago, the patient investor with the 60{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} stock allocation would have had about $540,000 by October 2018, versus $410,000 for the impatient investor. In dollar terms, a difference of $130,000.

Stay the course

Returns in chart reflect hypothetical portfolio outcomes from 1996 to 2018 using market returns. Stocks: S&P 500®Index return. Bonds: Bloomberg Barclays US Aggregate Bond Index return. All return data above based on a starting wealth level of $100,000 with no subsequent contributions or redemptions. Investor Portfolio: stock allocation was reduced from 90{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of total assets to 20{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of total assets on Sep. 30, 2002 and on Dec. 31, 2008, and then the stock allocation was increased from 20{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} to 90{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} of total assets on Mar. 31, 2004 and June 30, 2013, respectively. Sources: Standard & Poor’s, Barclays Capital, Fidelity Investments, as of November, 2018.

Be diversified

An old adage says that there is no free lunch in investing, meaning that if you want to increase potential returns, you have to accept more potential risk. But diversification is often said to be the exception to the rule—a free lunch that lets you improve the potential trade-off between risk and reward.

Successful investors know that diversification can help control risk—and their own emotions. Consider the performance of 3 hypothetical portfolios in the wake of the 2008–2009 financial crisis: a diversified portfolio of 70{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} stocks, 25{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} bonds, and 5{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} short-term investments; a 100{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} stock portfolio; and an all-cash portfolio.

By the end of February 2009, both the all-stock and the diversified portfolios would have declined sharply (50{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} and 35{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}, respectively), while the all-cash portfolio would have risen 1.6{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}. 5 years after the bottom, the all-stock portfolio would have been the clear winner: up 162{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}, versus 100{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} for the diversified portfolio and just 0.3{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} for the cash portfolio. But over a longer period—from January 2008 through February 2014—the diversified and all-stock portfolios would have been neck-and-neck: up 30{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} and 32{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31}, respectively.

This is what diversification is about. It will not maximize gains in rising stock markets, but it can capture a substantial portion of the gains over the longer term, with less volatility than just investing in stocks. That smoother ride will likely make it easier for you to stay the course when the market shakes, rattles, and rolls.

A good habit is to diversify among stocks, bonds, and cash, but also within those categories and among investment types. Diversification cannot guarantee gains, or that you won’t experience a loss, but does aim to provide a reasonable trade-off of risk and reward for your personal situation. On the stock front, consider diversifying across regions, sectors, investment styles (value and growth) and size (small-, mid-, and large-cap stocks). On the bond front, consider diversifying across different credit qualities, maturities, and issuers.

Consider low-fee investment products that offer good value

Savvy investors know they can’t control the market—or even the success of the fund managers they choose. What they can control is costs. A study by independent research company Morningstar found that expense ratios are the most reliable predictor of future fund performance—in terms of total return, and future risk-adjusted return ratings. Fidelity research has also shown that picking low-cost funds is one way to improve average historical results of large-cap stock funds relative to comparable index funds.

Fidelity has also found great variation among brokers in terms of commission and execution—by comparing the executed price of a security with the best bid or offer at the time of the trade. The cost of trading impacts your returns.

Focus on generating after-tax returns

While investors may spend a lot of time thinking about what parts of the market to invest in, successful investors know that’s not the end of the story. They focus not just on what they make, but what they keep after taxes. That’s why it is important to consider the investment account type and the tax characteristics of the investments that you have.

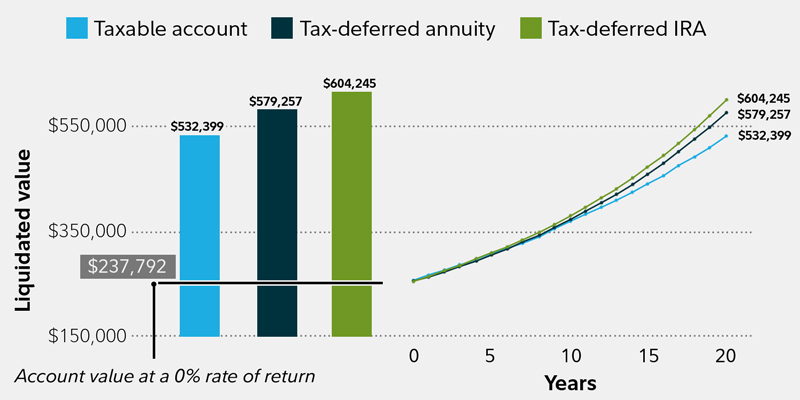

Accounts that offer tax benefits, like 401(k)s, IRAs, and certain annuities, can change to have the potential to help generate higher after-tax returns. This is what is known as “account location”—how much of your money to put into different types of accounts, based on each account’s respective tax treatment. Then consider “asset location”—which type of investments you keep in each account, based on the tax efficiency of the investment and the tax treatment of the account type.

Consider putting the least tax-efficient investments (for example, taxable bonds whose interest payments are taxed at relatively high ordinary income tax rates) in tax-deferred accounts like 401(k)s and IRAs. Put more tax-efficient investments (low-turnover funds like index funds or ETFs, and municipal bonds, where interest is typically free from federal income tax) in taxable accounts.

Read Viewpoints on Fidelity.com: Why asset location matters

Consider the example in the chart. A hypothetical $250,000 portfolio is invested and returns 6{e1706a52c3b3138427a8e72931d9d59b6d08ac610477d60aad46d317c02b8d31} annually for 20 years. The different tax treatments of a brokerage, annuity, and tax-deferred IRA, along with fees for those accounts, could create a significant difference in the final value of the investment.

Location has the potential to improve performance

This hypothetical example is not intended to predict or project investment results. Your actual results may be higher or lower than those shown here. See footnote 5 for details.

The bottom line

There is a lot of complexity in the financial world, but some of the most important habits of successful investors are pretty simple. If you build a smart plan and stick with it, save enough, make reasonable investment choices, and beware of taxes, you will have adopted some of the key traits that may lead to investing success.

Next steps to consider

See how an advisor can help you grow and protect your wealth.

Explore how to invest your money and get investing ideas to match your goals.